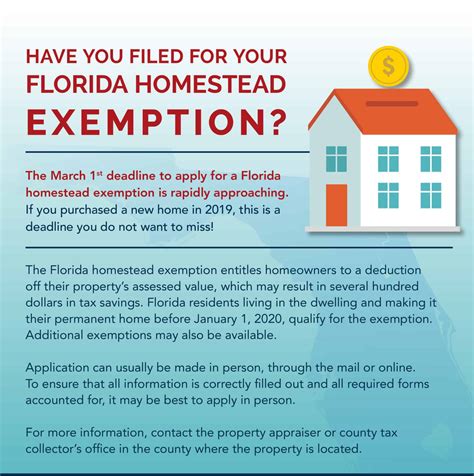

Are you a homeowner in Alachua County, Florida? If so, you may be eligible for a homestead exemption, which can help reduce your property taxes. The homestead exemption is a valuable benefit that can save you money on your annual tax bill. However, the application process can seem daunting, especially for first-time applicants. In this article, we will guide you through the easy steps to apply online for Alachua County homestead exemption.

Understanding the Benefits of Homestead Exemption

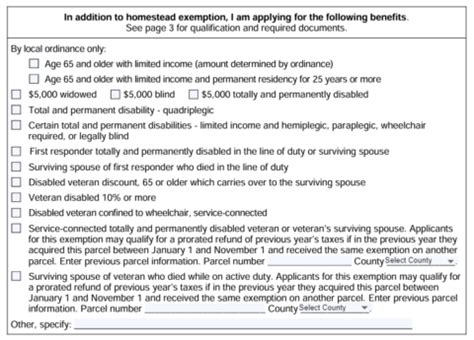

Before we dive into the application process, let's quickly review the benefits of homestead exemption. The homestead exemption is a tax break that allows eligible homeowners to reduce their taxable property value, resulting in lower property taxes. In Alachua County, the homestead exemption can save you up to $50,000 on your taxable property value.

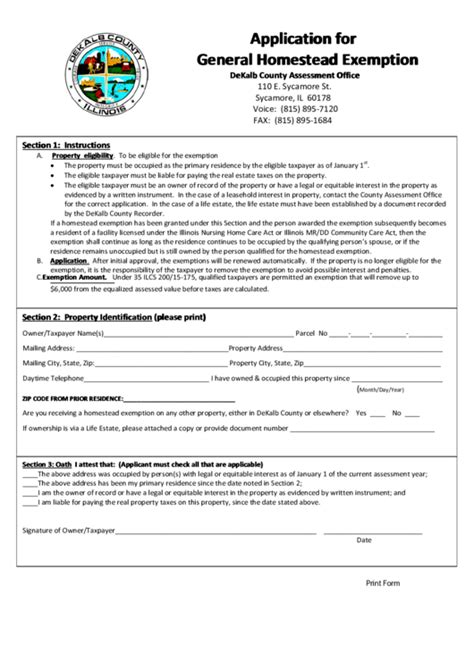

To qualify for the homestead exemption, you must meet certain eligibility requirements, including:

- Owning a primary residence in Alachua County

- Being a Florida resident

- Using the property as your permanent residence

Step 1: Gather Required Documents

Before you start the application process, make sure you have all the required documents ready. You will need:

- A valid Florida driver's license or state ID

- A copy of your deed or property title

- A copy of your social security card or W-2 form

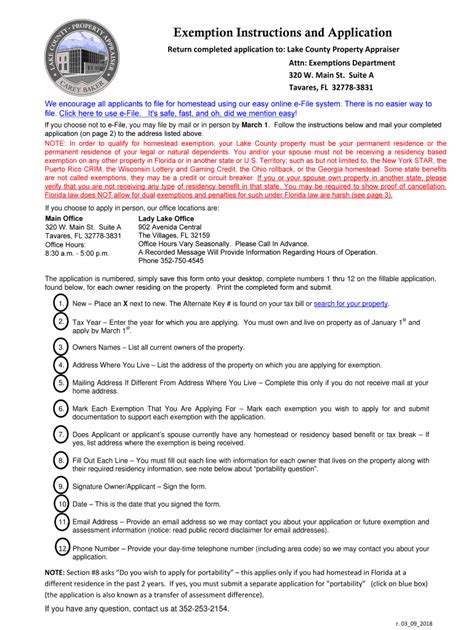

Step 2: Create an Account on the Alachua County Property Appraiser Website

To apply online for the homestead exemption, you will need to create an account on the Alachua County Property Appraiser website. Follow these steps:

- Go to the Alachua County Property Appraiser website at .

- Click on the "Apply for Homestead Exemption" button.

- Click on "Create an Account" and follow the prompts to create a new account.

Step 3: Fill Out the Homestead Exemption Application

Once you have created an account, you can fill out the homestead exemption application. The application will ask for information about your property, including:

- Property address

- Property type (single-family home, condo, etc.)

- Date of purchase

- Purchase price

You will also need to upload the required documents, including your deed, driver's license, and social security card.

Step 4: Review and Submit Your Application

Once you have completed the application, review it carefully to ensure that all the information is accurate and complete. Make sure to upload all the required documents.

When you are ready, submit your application. You will receive a confirmation email with a reference number. Keep this number handy, as you will need it to track the status of your application.

Step 5: Track the Status of Your Application

After submitting your application, you can track the status of your application online. Follow these steps:

- Log in to your account on the Alachua County Property Appraiser website.

- Click on the "Track My Application" button.

- Enter your reference number and follow the prompts to track the status of your application.

Gallery of Alachua County Homestead Exemption

FAQs

What is the deadline to apply for homestead exemption in Alachua County?

+The deadline to apply for homestead exemption in Alachua County is March 1st of each year.

How much can I save with the homestead exemption in Alachua County?

+The homestead exemption in Alachua County can save you up to $50,000 on your taxable property value.

What documents do I need to apply for homestead exemption in Alachua County?

+You will need a valid Florida driver's license or state ID, a copy of your deed or property title, and a copy of your social security card or W-2 form.

Conclusion

Applying online for Alachua County homestead exemption is a straightforward process that can save you time and money. By following the easy steps outlined in this article, you can reduce your taxable property value and lower your property taxes. Don't miss out on this valuable benefit – apply online today!