Are you a resident of Maine looking to apply for the Business Equipment Tax Reimbursement Program (BETR), also known as the BETR program or more commonly referred to as the "Brap" program? This program is designed to reimburse businesses for a portion of the local property taxes paid on qualified business equipment. In this article, we will guide you through the 5 easy steps to apply for Brap in Maine.

What is the Brap Program?

The Brap program is a tax reimbursement program designed to support businesses in Maine by reimbursing a portion of the local property taxes paid on qualified business equipment. The program aims to encourage businesses to invest in new equipment, expand their operations, and create jobs in the state.

Step 1: Determine Eligibility

To apply for the Brap program, your business must meet certain eligibility criteria. These criteria include:

- The business must be located in Maine

- The business must be a for-profit entity

- The business must have qualified business equipment (e.g., machinery, equipment, and furniture)

- The business must have paid local property taxes on the qualified business equipment

Qualified Business Equipment

Qualified business equipment includes, but is not limited to:

- Machinery and equipment used in manufacturing, processing, or assembling

- Computer equipment and software

- Furniture and fixtures

- Vehicles and equipment used for business purposes

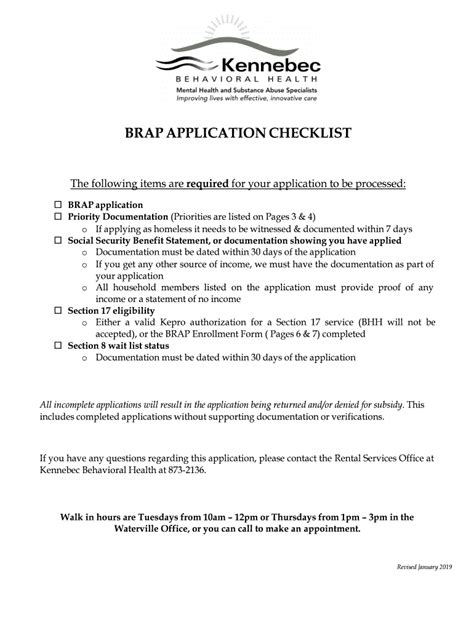

Step 2: Gather Required Documents

To apply for the Brap program, you will need to gather the following documents:

- Business registration documents (e.g., articles of incorporation, business license)

- Proof of business location in Maine (e.g., utility bills, lease agreements)

- Proof of payment of local property taxes on qualified business equipment (e.g., tax bills, payment receipts)

- Description of qualified business equipment, including the type, cost, and date of purchase

Step 3: Complete the Application Form

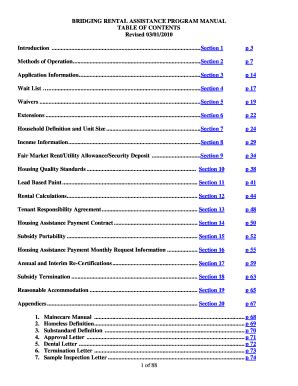

The Brap application form is available on the Maine Revenue Services website. The form requires you to provide information about your business, including the business name, address, and contact information. You will also need to provide information about the qualified business equipment, including the type, cost, and date of purchase.

Application Deadline

The application deadline for the Brap program is typically April 1st of each year. However, it is recommended that you submit your application as soon as possible after the tax year ends (December 31st).

Step 4: Submit the Application

Once you have completed the application form and gathered all the required documents, you can submit your application to the Maine Revenue Services. You can submit your application online or by mail.

Step 5: Receive Reimbursement

If your application is approved, you will receive a reimbursement check from the Maine Revenue Services. The reimbursement amount will be based on the local property taxes paid on the qualified business equipment.

We hope this article has provided you with a clear understanding of the Brap program and the application process. If you have any further questions or need assistance with your application, please don't hesitate to contact us.

What is the Brap program?

+The Brap program is a tax reimbursement program designed to support businesses in Maine by reimbursing a portion of the local property taxes paid on qualified business equipment.

What is qualified business equipment?

+Qualified business equipment includes, but is not limited to, machinery and equipment used in manufacturing, processing, or assembling, computer equipment and software, furniture and fixtures, and vehicles and equipment used for business purposes.

How do I apply for the Brap program?

+You can apply for the Brap program by completing the application form and submitting it to the Maine Revenue Services along with the required documents.

We encourage you to share your thoughts and experiences with the Brap program in the comments section below.