As the drone industry continues to soar, the need for comprehensive insurance coverage has become increasingly important. Whether you're a recreational drone enthusiast or a professional operator, having the right insurance policy in place can provide peace of mind and financial protection in the event of an accident or unexpected event.

Drone insurance applications can seem daunting, but with the right guidance, you can navigate the process with ease. In this article, we'll walk you through the steps to secure your flight with a drone insurance application that's easy to understand and complete.

Understanding Drone Insurance

Before we dive into the application process, it's essential to understand the basics of drone insurance. Drone insurance policies typically cover damage to the drone, liability for injuries or property damage, and other related risks. Policies can vary depending on the type of drone, usage, and location.

There are two primary types of drone insurance:

- Hull insurance: Covers damage to the drone itself, including the airframe, engine, and other components.

- Liability insurance: Covers damages or injuries caused by the drone to third parties, including people and property.

Gathering Required Information

To complete a drone insurance application, you'll need to gather the following information:

- Drone details: Make, model, and serial number of your drone

- Usage: Recreational, commercial, or a combination of both

- Location: Where you plan to operate your drone

- Pilot experience: Your level of experience and training

- Value: The value of your drone and any additional equipment

Step-by-Step Application Process

Now that you have the required information, let's walk through the step-by-step application process:

Step 1: Choose Your Insurance Provider

Research and compare different insurance providers to find the one that best suits your needs. Look for providers that specialize in drone insurance and offer flexible policies.

Step 2: Determine Your Coverage Needs

Based on your usage, location, and pilot experience, determine the level of coverage you need. Consider the value of your drone and any additional equipment.

Step 3: Complete the Application Form

Once you've determined your coverage needs, complete the application form provided by your chosen insurance provider. The form will typically ask for the information you gathered earlier.

Step 4: Review and Submit Your Application

Review your application carefully to ensure all information is accurate and complete. Submit your application to the insurance provider for processing.

Tips and Best Practices

To ensure a smooth application process, keep the following tips and best practices in mind:

- Be honest and accurate: Provide truthful and accurate information to avoid any potential issues with your policy.

- Read the fine print: Carefully review your policy to understand what is covered and what is not.

- Ask questions: Don't hesitate to ask your insurance provider if you have any questions or concerns.

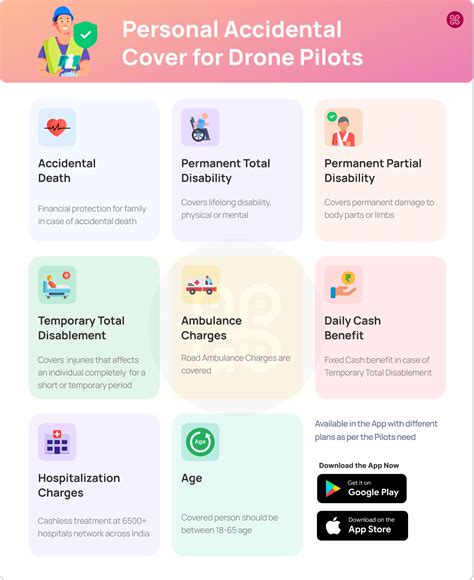

Gallery of Drone Insurance Application

FAQs

What is drone insurance?

+Drone insurance is a type of insurance policy that covers damage to the drone, liability for injuries or property damage, and other related risks.

Do I need drone insurance?

+Yes, drone insurance is highly recommended, especially if you plan to operate your drone for commercial purposes or in high-risk areas.

How much does drone insurance cost?

+The cost of drone insurance varies depending on the type of drone, usage, location, and coverage level. Expect to pay anywhere from $500 to $5,000 per year.

By following the steps outlined in this article, you can secure your flight with a drone insurance application that's easy to understand and complete. Remember to choose a reputable insurance provider, determine your coverage needs, and carefully review your policy to ensure you're fully protected.