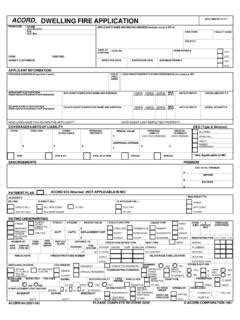

Dwelling fire insurance is a crucial aspect of protecting your home and personal property from unforeseen damages or losses. One of the most widely used insurance applications for dwelling fire insurance is the Acord application. The Acord application is a standardized form that helps insurance companies assess the risk associated with insuring a particular property. In this article, we will explore five essential tips to help you navigate the Acord application process for dwelling fire insurance.

Understanding the Acord Application Process

Before we dive into the tips, it's essential to understand the Acord application process. The Acord application is a comprehensive form that requires you to provide detailed information about your property, including its location, value, and risk factors. The application is usually divided into several sections, each focusing on a specific aspect of the property. Insurance companies use this information to determine the premium and coverage options for your dwelling fire insurance policy.

Tip 1: Provide Accurate Property Information

The first and most critical tip is to provide accurate property information. This includes the property's location, age, size, and construction type. Ensure that you provide the correct address, including the street number, city, state, and zip code. Additionally, provide detailed information about the property's value, including its replacement cost and actual cash value.

Tip 2: Disclose All Risk Factors

Risk Factors to Consider

When completing the Acord application, it's essential to disclose all risk factors associated with your property. This includes:

- Location risks, such as proximity to flood zones or high-crime areas

- Property risks, such as outdated electrical or plumbing systems

- Occupancy risks, such as renting out the property or using it for business purposes

Failing to disclose risk factors can lead to policy cancellations or claims denials. Ensure that you provide detailed information about all risk factors associated with your property.

Tip 3: Attach Required Documents

Required Documents

The Acord application may require you to attach specific documents, such as:

- Property deeds or titles

- Appraisal reports

- Inspection reports

- Repair estimates

Ensure that you attach all required documents to the application. Failure to do so may delay the underwriting process or lead to policy cancellations.

Tip 4: Review and Edit the Application

Review and Edit the Application

Before submitting the Acord application, review and edit it carefully. Ensure that all information is accurate and complete. Check for any errors or omissions that may affect the underwriting process.

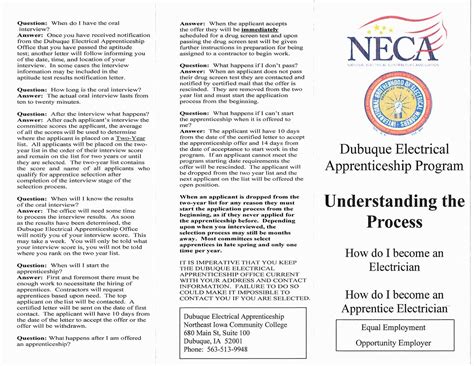

Tip 5: Seek Professional Help

Seek Professional Help

If you're unsure about any aspect of the Acord application, seek professional help. Insurance agents or brokers can guide you through the process and ensure that you provide accurate and complete information.

Gallery of Dwelling Fire Insurance Tips:

FAQ Section:

What is the Acord application?

+The Acord application is a standardized form used by insurance companies to assess the risk associated with insuring a particular property.

Why is it essential to provide accurate property information?

+Providing accurate property information helps insurance companies determine the correct premium and coverage options for your dwelling fire insurance policy.

What happens if I fail to disclose risk factors?

+Failing to disclose risk factors can lead to policy cancellations or claims denials.

By following these five tips, you can ensure a smooth and accurate Acord application process for your dwelling fire insurance. Remember to provide accurate property information, disclose all risk factors, attach required documents, review and edit the application, and seek professional help when needed.