Equipment rental companies play a vital role in various industries, providing essential machinery and tools to construction, event management, and other sectors. However, renting equipment comes with its own set of risks, including damage, theft, and liability. To mitigate these risks, equipment rental companies need to have the right insurance coverage in place. In this article, we will explore five ways to ace an equipment rental insurance application.

The Importance of Equipment Rental Insurance

Equipment rental insurance is a specialized type of coverage that protects equipment rental companies from financial losses due to equipment damage, theft, or liability. This type of insurance is essential for equipment rental companies, as it helps to minimize the risk of financial loss and ensures business continuity.

Without adequate insurance coverage, equipment rental companies may face significant financial losses, which can impact their ability to operate and provide services to clients. Moreover, equipment rental insurance can also help to protect the company's reputation and maintain customer trust.

Understanding Equipment Rental Insurance Policies

Before applying for equipment rental insurance, it is essential to understand the different types of policies available. There are several types of equipment rental insurance policies, including:

- Equipment damage insurance: This type of policy covers damage to rented equipment due to accidents, negligence, or other unforeseen events.

- Liability insurance: This type of policy covers liability for injuries or property damage caused by rented equipment.

- Theft insurance: This type of policy covers theft of rented equipment.

5 Ways to Ace an Equipment Rental Insurance Application

Now that we have discussed the importance of equipment rental insurance and the different types of policies available, let's explore five ways to ace an equipment rental insurance application:

1. Provide Accurate and Complete Information

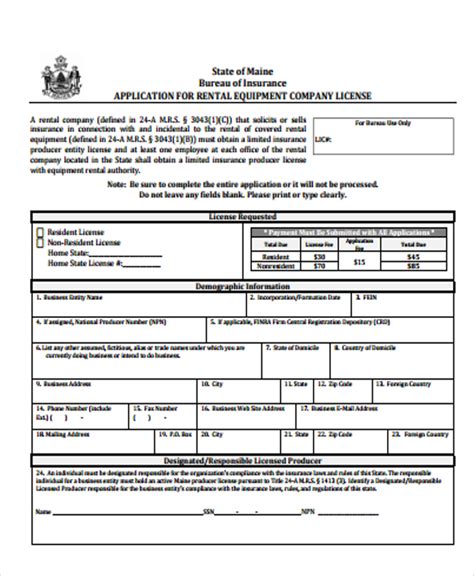

When applying for equipment rental insurance, it is essential to provide accurate and complete information about your business, including the types of equipment you rent, the locations where you operate, and the number of employees you have. This information will help insurers to assess the level of risk associated with your business and provide you with a more accurate quote.

Make sure to provide detailed information about your equipment, including the make, model, and serial number of each item. You should also provide information about your rental agreements, including the terms and conditions of each contract.

2. Demonstrate a Good Loss History

Insurers will typically review your loss history to determine the level of risk associated with your business. A good loss history can help to reduce your premiums and improve your chances of getting approved for coverage.

To demonstrate a good loss history, make sure to keep accurate records of any losses or claims you have made in the past. You should also provide information about any safety protocols or risk management strategies you have in place to minimize the risk of losses.

3. Show a Commitment to Risk Management

Insurers want to know that you are committed to managing risk and minimizing the likelihood of losses. To demonstrate this commitment, make sure to implement safety protocols and risk management strategies, such as regular equipment maintenance, employee training, and incident reporting.

You should also provide information about any risk management certifications or training programs you have completed. This will help to demonstrate your commitment to risk management and reduce your premiums.

4. Provide Financial Information

Insurers will typically require financial information about your business, including your annual revenue, expenses, and profit margins. This information will help them to assess your creditworthiness and determine the level of risk associated with your business.

Make sure to provide accurate and up-to-date financial information, including your balance sheet, income statement, and cash flow statement. You should also provide information about any financial ratios or metrics that demonstrate your financial stability.

5. Work with a Broker or Agent

Finally, working with a broker or agent can help you to ace your equipment rental insurance application. Brokers and agents have experience working with insurers and can help you to navigate the application process.

They can also provide valuable advice and guidance on the types of policies available and the level of coverage you need. Moreover, brokers and agents can help you to negotiate with insurers and get the best possible quote for your business.

Gallery of Equipment Rental Insurance

Frequently Asked Questions

What is equipment rental insurance?

+Equipment rental insurance is a type of insurance that protects equipment rental companies from financial losses due to equipment damage, theft, or liability.

Why do I need equipment rental insurance?

+You need equipment rental insurance to protect your business from financial losses due to equipment damage, theft, or liability. This type of insurance can help to minimize the risk of financial loss and ensure business continuity.

How do I apply for equipment rental insurance?

+To apply for equipment rental insurance, you should provide accurate and complete information about your business, including the types of equipment you rent, the locations where you operate, and the number of employees you have. You should also demonstrate a good loss history and show a commitment to risk management.

In conclusion, acing an equipment rental insurance application requires careful planning and preparation. By providing accurate and complete information, demonstrating a good loss history, showing a commitment to risk management, providing financial information, and working with a broker or agent, you can increase your chances of getting approved for coverage and reduce your premiums. Remember to always read the policy documents carefully and ask questions before signing up for coverage.