In Illinois, the rental application process is a critical step for both landlords and tenants. For landlords, it's a chance to carefully vet potential renters, while for tenants, it's an opportunity to showcase their creditworthiness and secure their dream home. However, navigating the Illinois rental application form can be overwhelming, especially for first-time renters or landlords. To help you through this process, we've compiled seven essential tips to keep in mind.

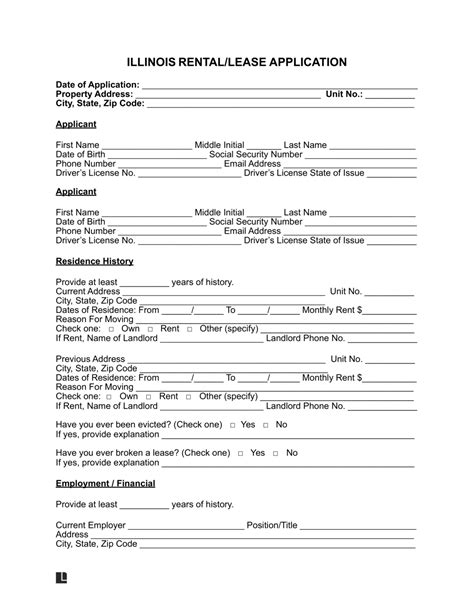

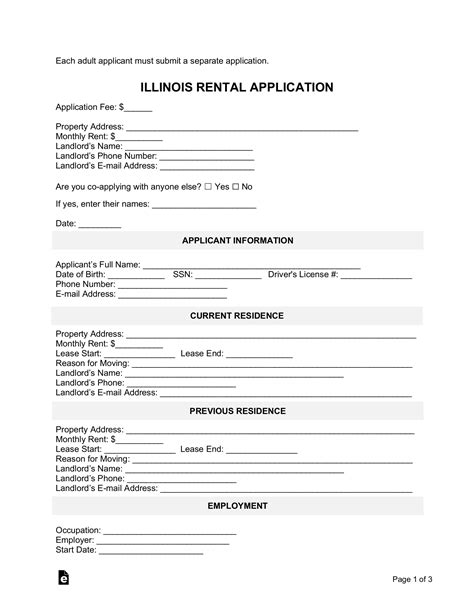

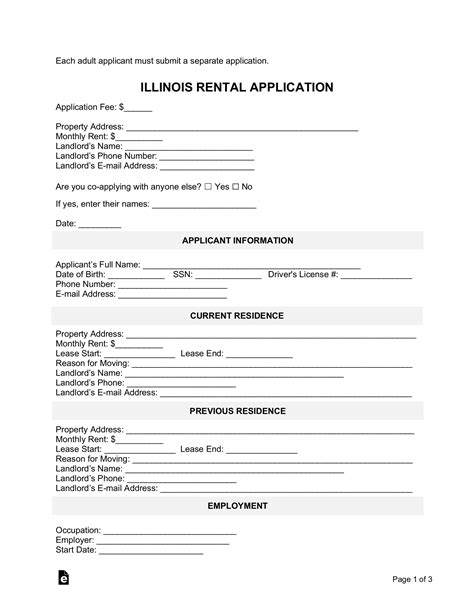

Understanding the Illinois Rental Application Form

Before we dive into the tips, it's crucial to understand what the Illinois rental application form entails. This document typically requests personal and financial information from the applicant, including their employment history, credit score, and rental history. The form may also ask for references, proof of income, and identification.

Tip 1: Ensure Accuracy and Completeness

When filling out the Illinois rental application form, it's essential to ensure that all information is accurate and complete. Inaccurate or incomplete information can lead to delays or even rejection. Double-check your employment history, credit score, and rental history to avoid any mistakes.

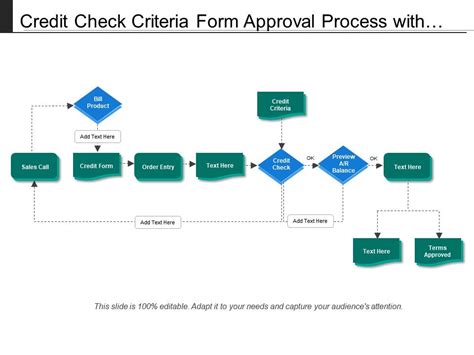

Tip 2: Understand the Credit Check Process

In Illinois, landlords are allowed to conduct credit checks on potential renters. However, they must follow the Fair Credit Reporting Act (FCRA) guidelines. As a tenant, it's essential to understand how credit checks work and what to expect. You can request a copy of your credit report and dispute any errors before applying.

Tip 3: Prepare for the Application Fee

In Illinois, landlords can charge an application fee, which typically ranges from $20 to $50. This fee covers the cost of processing the application, including credit checks and background screenings. Be prepared to pay this fee when submitting your application.

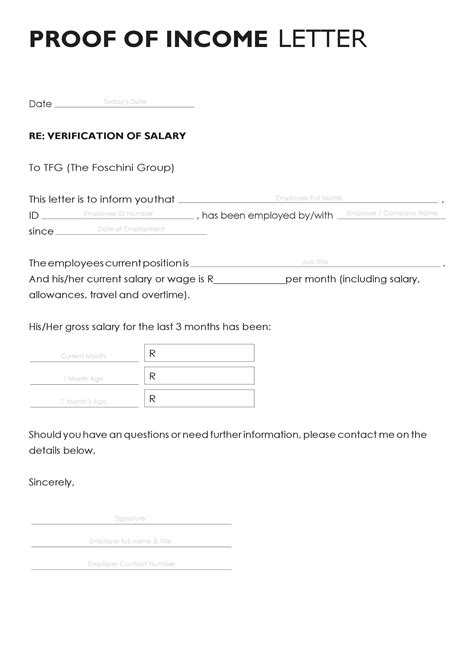

Tip 4: Provide Proof of Income and Employment

To qualify for a rental property in Illinois, you'll need to provide proof of income and employment. This can include pay stubs, W-2 forms, or a letter from your employer. Ensure you have these documents ready when applying.

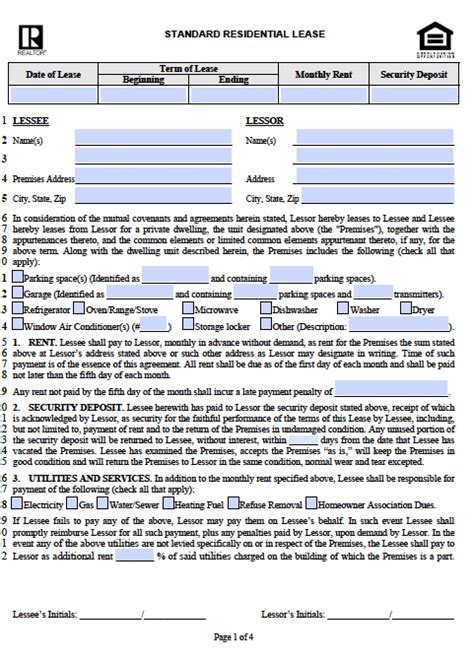

Tip 5: Review the Lease Agreement

Before signing the lease agreement, review it carefully to ensure you understand all the terms and conditions. Pay attention to the rent, security deposit, and any additional fees. Ask questions if you're unsure about anything.

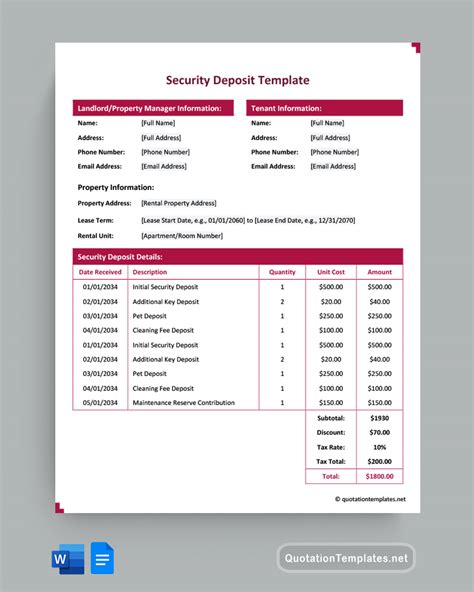

Tip 6: Understand the Security Deposit

In Illinois, landlords can charge a security deposit, which typically ranges from one to two months' rent. Understand how the security deposit works and what's expected of you as a tenant.

Tip 7: Ask Questions

Finally, don't be afraid to ask questions during the application process. If you're unsure about anything, ask the landlord or property manager for clarification. This will help you avoid any potential issues down the line.

By following these seven essential tips, you'll be well-prepared to navigate the Illinois rental application form and secure your dream home.

Gallery of Illinois Rental Application Form

FAQ Section

What is the typical application fee for a rental property in Illinois?

+The typical application fee for a rental property in Illinois ranges from $20 to $50.

Can I negotiate the rent on a rental property in Illinois?

+Yes, you can try to negotiate the rent on a rental property in Illinois. However, the landlord is not obligated to accept your offer.

How long does it take to process a rental application in Illinois?

+The processing time for a rental application in Illinois typically takes 2-5 business days.