Credit applications can be a daunting task, especially for those who are new to the process. With numerous requirements and paperwork to complete, it's easy to feel overwhelmed. However, understanding the credit application process can help individuals and businesses navigate the system with ease. In this article, we'll delve into the world of credit applications, exploring the benefits, types, and steps involved in securing approval.

What is a Credit Application?

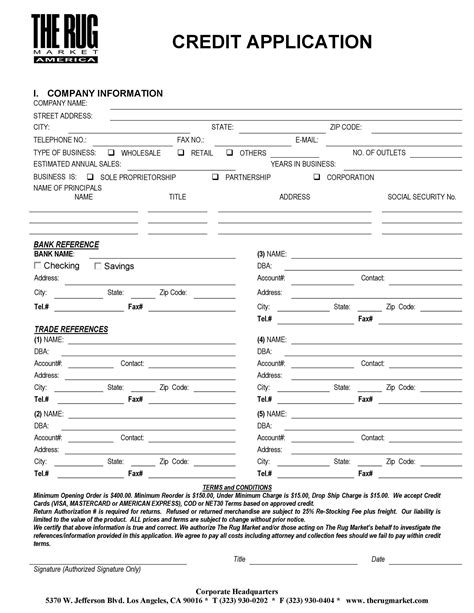

A credit application is a formal request for credit, which can be submitted to a lender, creditor, or financial institution. The application provides the lender with necessary information to assess the applicant's creditworthiness and make an informed decision about loan approval. Credit applications can be used for various purposes, such as personal loans, mortgages, credit cards, and business loans.

Types of Credit Applications

There are several types of credit applications, each with its unique characteristics and requirements. Some of the most common types include:

- Personal credit applications: Used for personal loans, credit cards, and mortgages.

- Business credit applications: Used for business loans, lines of credit, and commercial mortgages.

- Secured credit applications: Require collateral, such as a mortgage or car loan.

- Unsecured credit applications: Do not require collateral, such as credit cards or personal loans.

Benefits of Credit Applications

Credit applications offer numerous benefits to individuals and businesses. Some of the advantages include:

- Access to funds: Credit applications provide access to funds for various purposes, such as purchasing a home, starting a business, or financing a large purchase.

- Flexibility: Credit applications can be customized to meet the specific needs of the applicant.

- Convenience: Credit applications can be submitted online, making it easier to apply for credit from the comfort of your own home.

Step-By-Step Guide to Approval

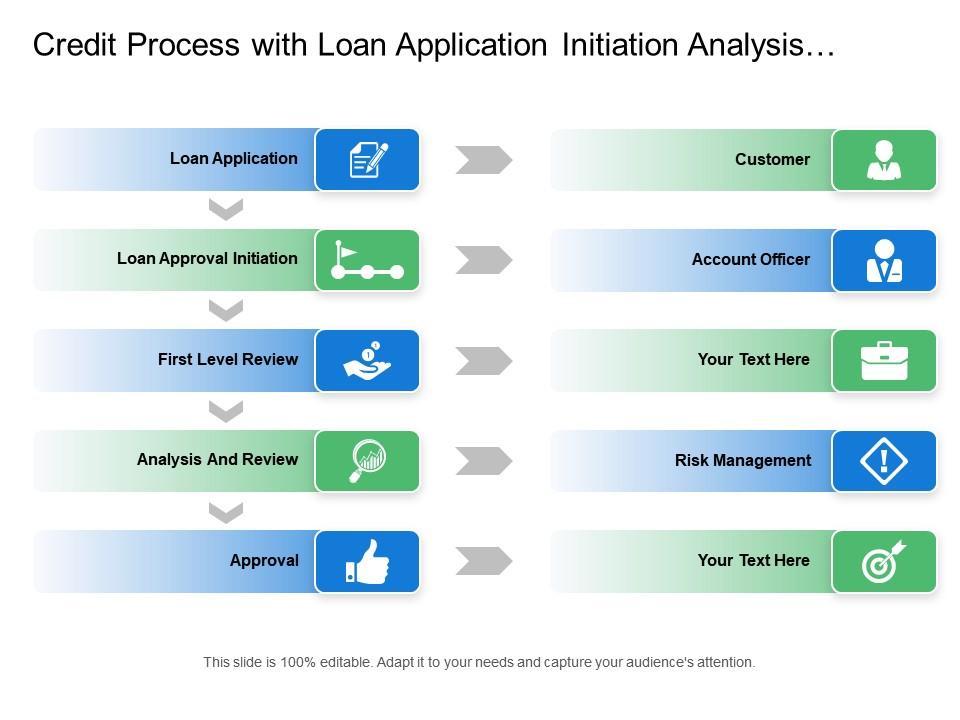

The credit application process involves several steps, which are outlined below:

- Check your credit score: Before submitting a credit application, it's essential to check your credit score. A good credit score can increase your chances of approval.

- Gather required documents: Collect all necessary documents, including identification, income proof, and employment verification.

- Choose a lender: Research and select a lender that meets your needs and offers competitive interest rates.

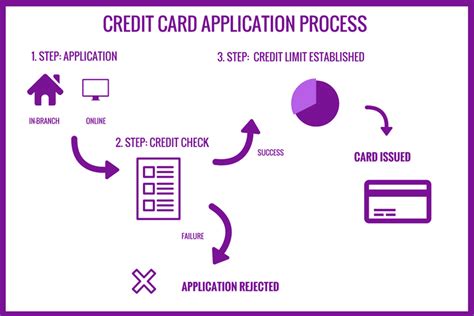

- Submit the application: Complete and submit the credit application, either online or in-person.

- Wait for approval: The lender will review your application and make a decision. This may take several days or weeks, depending on the lender and the complexity of the application.

- Review and sign the agreement: Once approved, review the loan agreement carefully and sign it to finalize the loan.

Tips for Approval

To increase your chances of approval, follow these tips:

- Maintain a good credit score: A good credit score can significantly improve your chances of approval.

- Provide accurate information: Ensure that all information provided is accurate and up-to-date.

- Meet the lender's requirements: Understand the lender's requirements and ensure that you meet them.

- Avoid multiple applications: Avoid submitting multiple credit applications in a short period, as this can negatively impact your credit score.

Common Mistakes to Avoid

When submitting a credit application, it's essential to avoid common mistakes that can lead to rejection. Some of the mistakes to avoid include:

- Inaccurate information: Providing inaccurate information can lead to rejection or even fraud.

- Insufficient documentation: Failing to provide required documentation can delay or reject the application.

- Poor credit history: A poor credit history can significantly reduce your chances of approval.

Conclusion

In conclusion, credit applications can be a complex and daunting task. However, by understanding the process and following the steps outlined above, individuals and businesses can increase their chances of approval. Remember to maintain a good credit score, provide accurate information, and avoid common mistakes to ensure a smooth and successful credit application process.

Gallery of Credit Application Tips

What is a credit application?

+A credit application is a formal request for credit, which can be submitted to a lender, creditor, or financial institution.

What are the benefits of credit applications?

+Credit applications offer numerous benefits, including access to funds, flexibility, and convenience.

How do I increase my chances of approval?

+To increase your chances of approval, maintain a good credit score, provide accurate information, and avoid common mistakes.