The world of entrepreneurship can be a thrilling ride, but it also comes with its fair share of risks and responsibilities. If you're a business owner in the hospitality industry, one of the most significant risks you face is liquor liability. This type of risk can arise when patrons consume alcohol at your establishment and then go on to cause harm to themselves or others. To mitigate this risk, it's essential to have the right insurance coverage in place. In this article, we'll guide you through the process of applying for liquor liability insurance and provide you with valuable insights to help you navigate the application process.

What is Liquor Liability Insurance?

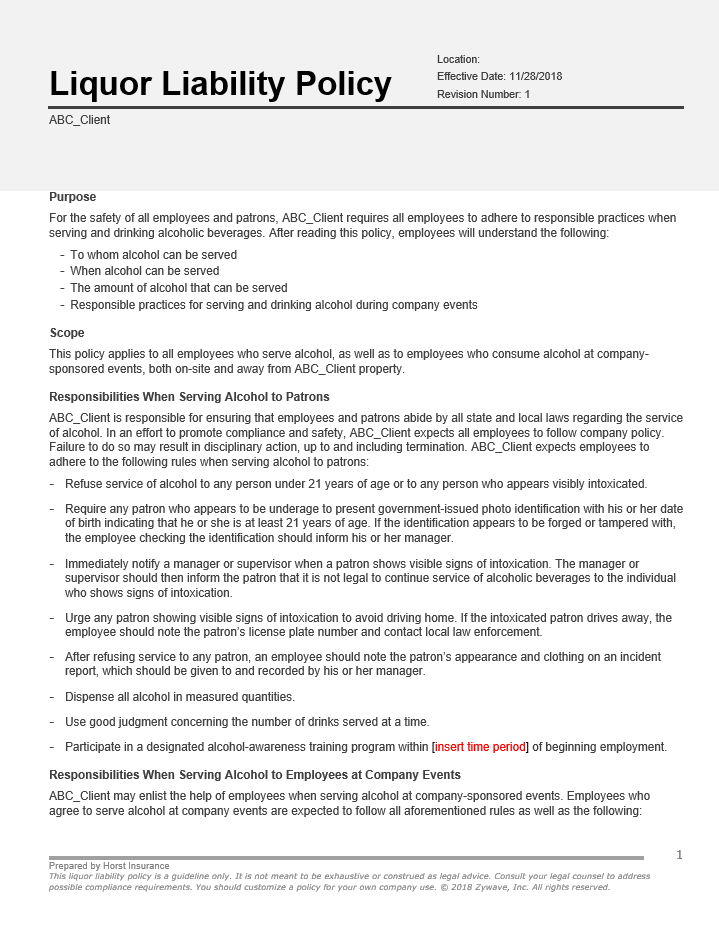

Liquor liability insurance is a type of insurance coverage that protects businesses from financial losses arising from claims related to the serving of alcohol. This type of insurance is particularly important for businesses in the hospitality industry, such as bars, restaurants, and nightclubs, as it helps to mitigate the risk of liability for damages or injuries caused by patrons who have consumed alcohol.

Types of Liquor Liability Insurance

There are several types of liquor liability insurance policies available, including:

- Host Liquor Liability Insurance: This type of insurance provides coverage for social hosts, such as event planners, caterers, and wedding venues, who may be held liable for damages or injuries caused by patrons who have consumed alcohol at their events.

- Dram Shop Liability Insurance: This type of insurance provides coverage for businesses that sell or serve alcohol, such as bars, restaurants, and nightclubs, for damages or injuries caused by patrons who have consumed alcohol at their establishments.

- Liquor Liability Umbrella Insurance: This type of insurance provides excess coverage above the limits of a primary liquor liability insurance policy, providing additional protection for businesses in the event of a large claim.

The Application Process

The application process for liquor liability insurance typically involves the following steps:

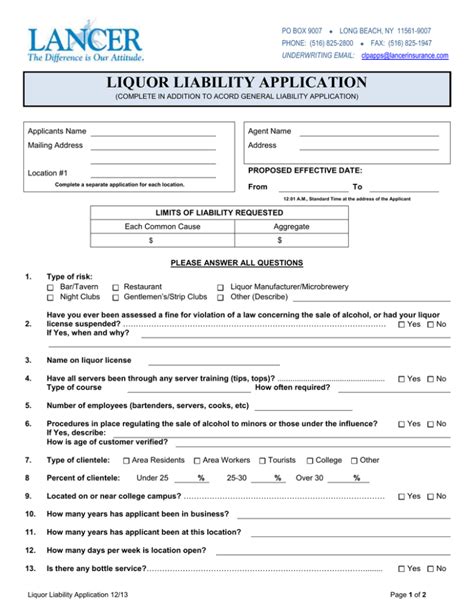

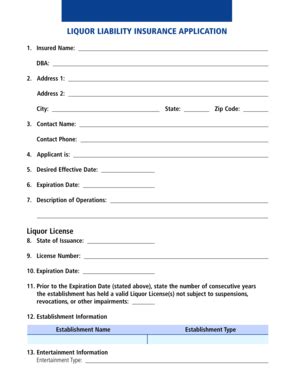

- Gather Required Information: Before you begin the application process, you'll need to gather certain information, including:

- Business name and address

- Type of business (bar, restaurant, nightclub, etc.)

- Number of employees

- Annual revenue

- Type of liquor license held (if applicable)

- List of all locations where liquor is served or sold

- Choose an Insurer: Once you have gathered the required information, you'll need to choose an insurer that offers liquor liability insurance. You can do this by researching different insurance companies online or by contacting a licensed insurance agent or broker.

- Complete the Application: Once you have chosen an insurer, you'll need to complete the application form. This form will typically ask for the information you gathered in step 1, as well as additional information about your business operations and risk management practices.

- Submit the Application: Once you have completed the application form, you'll need to submit it to the insurer for review.

- Pay the Premium: If your application is approved, you'll need to pay the premium for the policy.

What to Expect During the Application Process

The application process for liquor liability insurance can be complex and time-consuming. Here are some things you can expect during the application process:

- Risk Assessment: The insurer will conduct a risk assessment of your business to determine the level of risk involved in insuring your business.

- Quote: Based on the risk assessment, the insurer will provide you with a quote for the premium.

- Policy Options: The insurer may offer you different policy options, including different coverage limits and deductibles.

- Underwriting: If you accept the quote, the insurer will conduct an underwriting review of your application to verify the information you provided.

Common Mistakes to Avoid

When applying for liquor liability insurance, there are several common mistakes to avoid, including:

- Inaccurate Information: Providing inaccurate information on the application form can lead to delayed or denied coverage.

- Insufficient Coverage: Failing to purchase sufficient coverage can leave your business vulnerable to financial losses in the event of a claim.

- Failing to Disclose: Failing to disclose important information, such as prior claims or risk management practices, can lead to denied coverage.

Tips for a Smooth Application Process

Here are some tips to help ensure a smooth application process:

- Work with a Licensed Insurance Agent or Broker: A licensed insurance agent or broker can help you navigate the application process and ensure that you have the right coverage for your business.

- Gather All Required Information: Make sure you have all the required information before starting the application process.

- Be Honest and Transparent: Be honest and transparent when providing information on the application form.

- Ask Questions: Don't be afraid to ask questions if you're unsure about any part of the application process.

Conclusion

Applying for liquor liability insurance can be a complex and time-consuming process. However, by understanding the different types of policies available, the application process, and common mistakes to avoid, you can ensure that your business is protected from financial losses arising from claims related to the serving of alcohol. Remember to work with a licensed insurance agent or broker, gather all required information, be honest and transparent, and ask questions if you're unsure about any part of the application process.

Gallery of Liquor Liability Insurance

What is liquor liability insurance?

+Liquor liability insurance is a type of insurance coverage that protects businesses from financial losses arising from claims related to the serving of alcohol.

What types of businesses need liquor liability insurance?

+Businesses that sell or serve alcohol, such as bars, restaurants, and nightclubs, need liquor liability insurance.

How do I apply for liquor liability insurance?

+You can apply for liquor liability insurance by contacting a licensed insurance agent or broker, gathering all required information, and completing the application form.