Establishing a strong business credit profile is essential for any entrepreneur or small business owner, and when it comes to automobile financing, having a good credit score can make a significant difference. For Nissan business owners, getting approved for business credit can be a game-changer, enabling them to access better loan terms, lower interest rates, and increased financing options. In this article, we will outline the 5 steps to Nissan business credit approval, providing valuable insights and practical tips to help you navigate the process successfully.

Understanding the Importance of Business Credit

Before we dive into the steps, it's crucial to understand why business credit is vital for Nissan business owners. A good business credit score can help you:

- Qualify for better loan terms and lower interest rates

- Increase your financing options and access to more significant loan amounts

- Establish a strong reputation with lenders and suppliers

- Reduce your personal liability and protect your personal credit score

Step 1: Check Your Personal Credit Report

Your personal credit score plays a significant role in determining your business creditworthiness. As a Nissan business owner, it's essential to check your personal credit report to identify any errors or areas for improvement. You can request a free credit report from the three major credit bureaus (Experian, TransUnion, and Equifax) once a year.

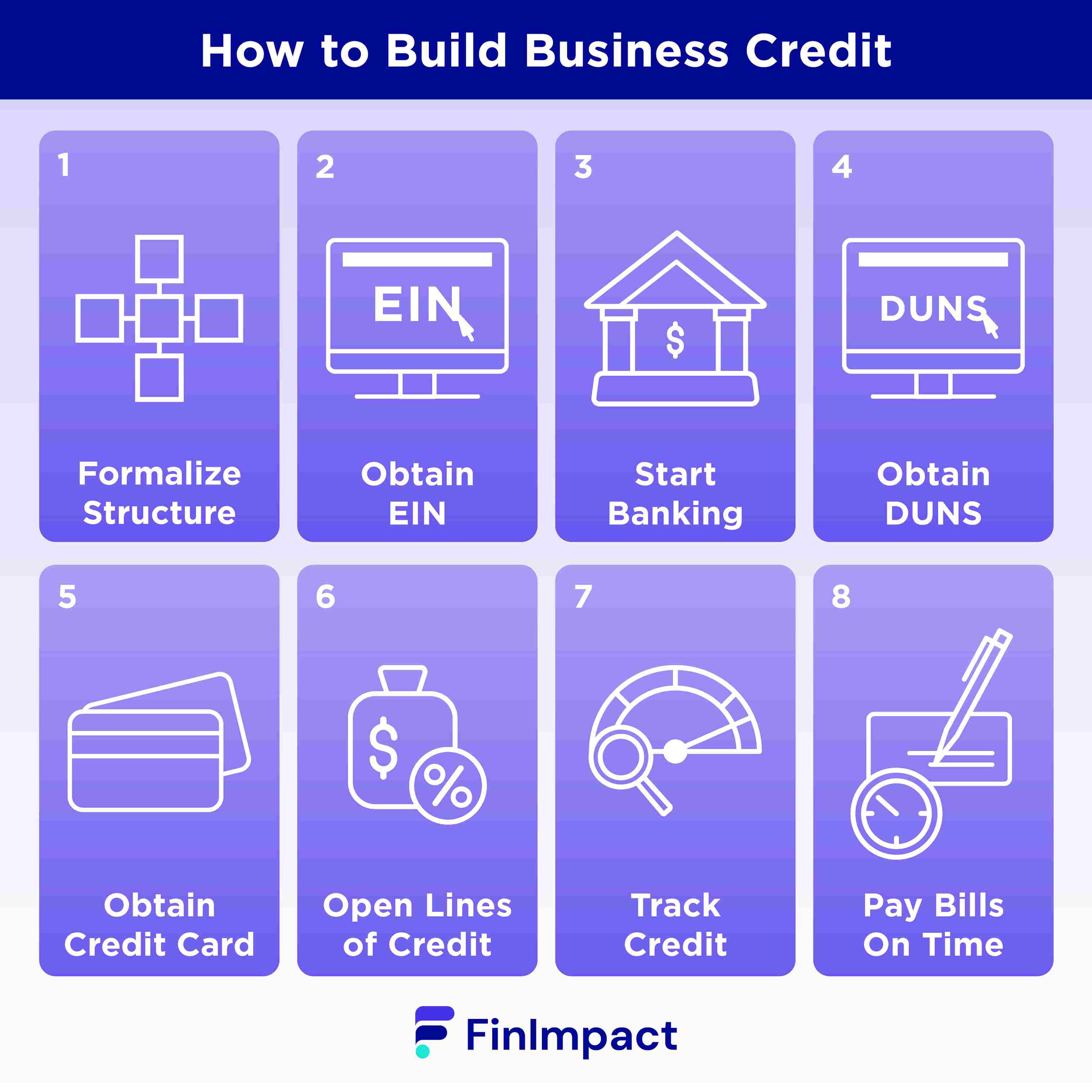

Step 2: Establish a Business Credit Profile

To establish a business credit profile, you'll need to register your business with the three major credit bureaus. This will help you create a separate credit identity for your business, which is essential for building a strong business credit profile. You can register your business by providing basic information such as your business name, address, and tax ID number.

Step 3: Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit number assigned to your business by the IRS. It's essential for tax purposes and helps you establish a separate business credit identity. You can apply for an EIN online through the IRS website, and it's usually processed within a few minutes.

Step 4: Open a Business Bank Account

Opening a business bank account is crucial for establishing a separate business credit identity. It helps you keep your personal and business finances separate, which is essential for building a strong business credit profile. When opening a business bank account, make sure to provide your business name, EIN, and other relevant documentation.

Step 5: Make On-Time Payments and Monitor Your Credit Report

Making on-time payments is essential for building a strong business credit profile. Ensure that you pay all your bills, loans, and credit card debts on time, and monitor your credit report regularly to identify any errors or areas for improvement. You can request a business credit report from the three major credit bureaus to track your progress.

Gallery of Business Credit Building

Frequently Asked Questions

What is business credit, and why is it important?

+Business credit refers to the creditworthiness of a business, which is essential for accessing loans, credit cards, and other financing options. A good business credit score can help you qualify for better loan terms, lower interest rates, and increased financing options.

How do I establish a business credit profile?

+To establish a business credit profile, you'll need to register your business with the three major credit bureaus, obtain an Employer Identification Number (EIN), and open a business bank account.

What is the importance of making on-time payments for business credit?

+Making on-time payments is essential for building a strong business credit profile. It helps you establish a positive credit history, which can improve your credit score and increase your chances of getting approved for loans and credit cards.

By following these 5 steps, you can improve your chances of getting approved for Nissan business credit. Remember to monitor your credit report regularly, make on-time payments, and maintain a good credit score to establish a strong business credit profile.