Overhead applications are a crucial part of various industries, including construction, manufacturing, and warehousing. Recording overhead applications is essential to ensure accurate tracking of expenses, efficient resource allocation, and informed decision-making. In this article, we will explore five methods to record overhead applications, highlighting their benefits, limitations, and practical examples.

Understanding Overhead Applications

Before diving into the recording methods, it's essential to understand what overhead applications entail. Overhead applications refer to the allocation of indirect costs, such as salaries, rent, and utilities, to specific departments, projects, or products. These costs are not directly related to the production process but are necessary for the overall operation of the business.

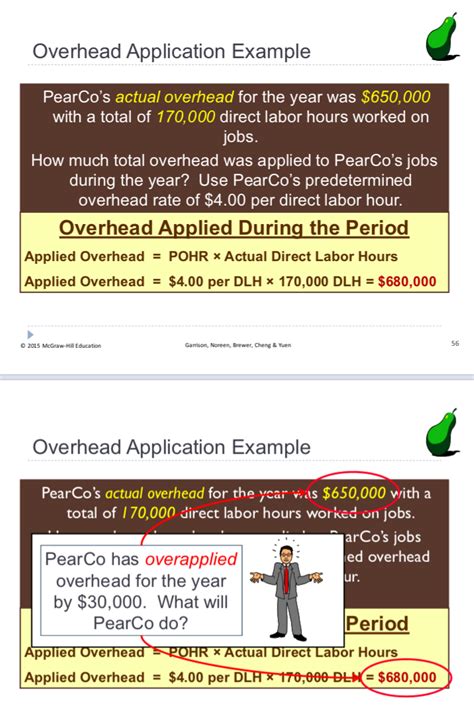

Method 1: Traditional Accounting Method

The traditional accounting method involves recording overhead applications using a manual or computerized accounting system. This method requires accounting personnel to track and allocate overhead costs to specific departments or projects using a predetermined formula or ratio.

Benefits:

- Easy to implement and understand

- Suitable for small businesses or organizations with simple overhead structures

Limitations:

- Time-consuming and prone to errors

- May not accurately reflect actual overhead costs

Example:

A construction company uses the traditional accounting method to record overhead applications. The company allocates 10% of its total overhead costs to each project based on the project's total labor hours.

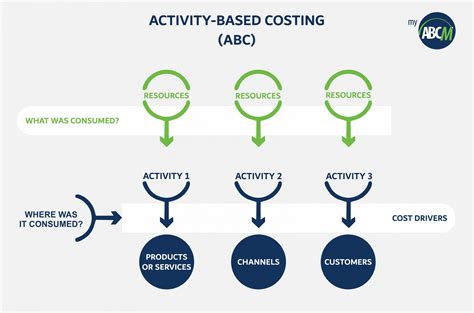

Method 2: Activity-Based Costing (ABC) Method

The ABC method involves recording overhead applications based on specific activities or tasks. This method requires identifying and tracking the activities that drive overhead costs and allocating them to specific departments or projects.

Benefits:

- More accurate and detailed overhead cost allocation

- Helps identify areas for cost reduction and process improvement

Limitations:

- Complex and time-consuming to implement

- Requires significant data collection and analysis

Example:

A manufacturing company uses the ABC method to record overhead applications. The company identifies three activities that drive overhead costs: machine maintenance, quality control, and material handling. The company allocates overhead costs to each department based on the number of activities performed.

Method 3: Departmental Overhead Rate Method

The departmental overhead rate method involves recording overhead applications based on a predetermined overhead rate for each department. This method requires calculating the total overhead costs for each department and allocating them to specific projects or products.

Benefits:

- Easy to implement and understand

- Suitable for organizations with multiple departments

Limitations:

- May not accurately reflect actual overhead costs

- Requires regular updates to overhead rates

Example:

A warehousing company uses the departmental overhead rate method to record overhead applications. The company calculates the total overhead costs for each department, such as receiving, storage, and shipping, and allocates them to specific projects based on the department's overhead rate.

Method 4: Standard Costing Method

The standard costing method involves recording overhead applications based on a predetermined standard cost for each product or project. This method requires calculating the standard cost of overhead for each product or project and allocating actual overhead costs to each product or project based on the standard cost.

Benefits:

- Easy to implement and understand

- Suitable for organizations with repetitive production processes

Limitations:

- May not accurately reflect actual overhead costs

- Requires regular updates to standard costs

Example:

A manufacturing company uses the standard costing method to record overhead applications. The company calculates the standard cost of overhead for each product and allocates actual overhead costs to each product based on the standard cost.

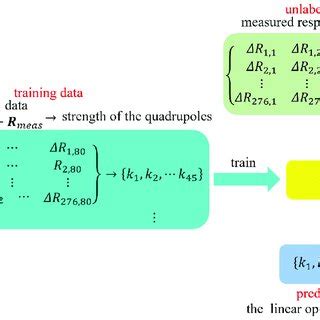

Method 5: Machine Learning-Based Method

The machine learning-based method involves recording overhead applications using machine learning algorithms and data analytics. This method requires collecting and analyzing large datasets of overhead costs and production data to identify patterns and trends.

Benefits:

- Highly accurate and detailed overhead cost allocation

- Helps identify areas for cost reduction and process improvement

Limitations:

- Complex and time-consuming to implement

- Requires significant data collection and analysis

Example:

A construction company uses the machine learning-based method to record overhead applications. The company collects and analyzes data on overhead costs, labor hours, and material usage to identify patterns and trends. The company uses machine learning algorithms to allocate overhead costs to specific projects based on the patterns and trends identified.

In conclusion, there are various methods to record overhead applications, each with its benefits and limitations. The choice of method depends on the organization's size, complexity, and specific needs. It's essential to carefully evaluate each method and consider factors such as accuracy, complexity, and resource requirements before selecting the most suitable method for your organization.

We hope this article has provided you with a comprehensive understanding of the different methods to record overhead applications. If you have any questions or need further clarification, please don't hesitate to ask. We'd love to hear your thoughts and feedback in the comments section below.

Gallery of Overhead Application Methods

FAQ Section

What is overhead application?

+Overhead application refers to the allocation of indirect costs, such as salaries, rent, and utilities, to specific departments, projects, or products.

Why is overhead application important?

+Overhead application is important because it helps organizations accurately track and allocate indirect costs, enabling informed decision-making and efficient resource allocation.

What are the different methods of overhead application?

+There are five methods of overhead application: traditional accounting method, activity-based costing method, departmental overhead rate method, standard costing method, and machine learning-based method.