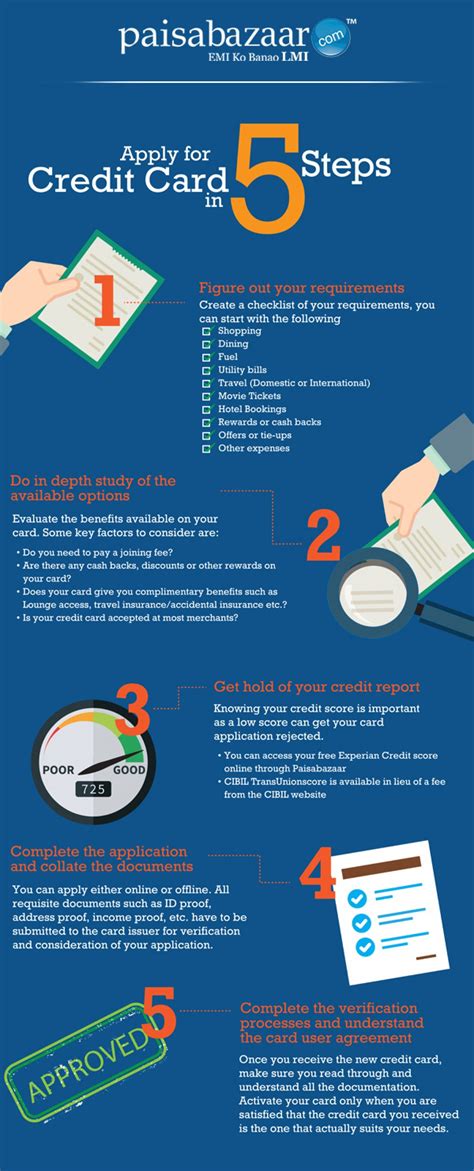

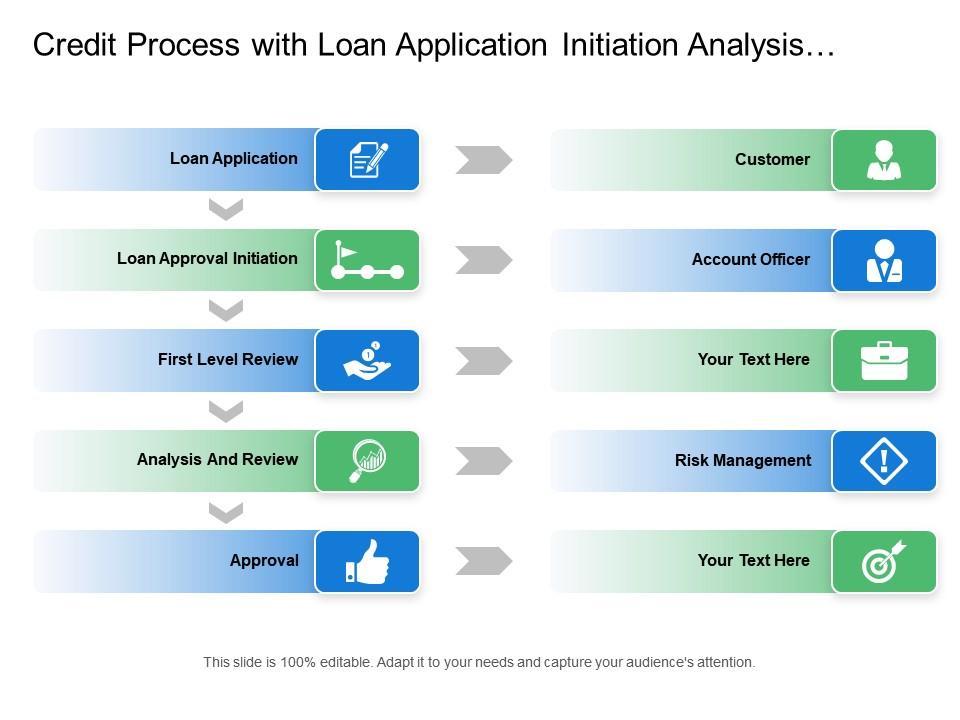

As a business owner, you're likely no stranger to the importance of maintaining a healthy cash flow. One way to achieve this is by offering credit terms to your customers, allowing them to pay for goods or services over a period of time. However, extending credit can be a double-edged sword - while it can help attract and retain customers, it also exposes your business to the risk of non-payment. That's where a principals credit application comes in. In this article, we'll break down the principals credit application process into 5 easy steps, helping you to better manage your credit risks and protect your business.

What is a Principals Credit Application?

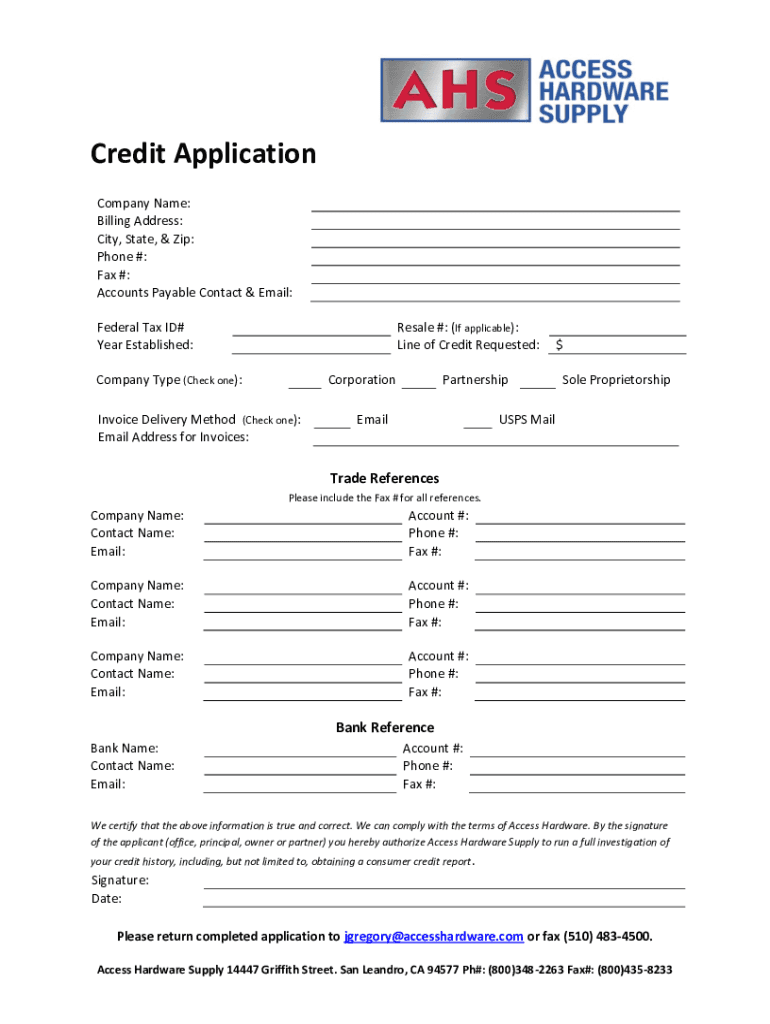

A principals credit application is a document used to assess the creditworthiness of a business or individual before extending credit. It provides valuable insights into the applicant's financial history, credit score, and other relevant information, helping you to make informed decisions about whether to approve or reject their credit application.

Step 1: Gathering Information

The first step in the principals credit application process is to gather relevant information about the applicant. This typically includes:

- Business or personal details, such as name, address, and contact information

- Financial statements, such as balance sheets and income statements

- Credit reports and scores

- Banking and payment history

- Trade references and other relevant information

Why is Gathering Information Important?

Gathering accurate and comprehensive information is crucial in assessing the creditworthiness of an applicant. It helps you to identify potential risks and make informed decisions about whether to approve or reject their credit application.

Step 2: Verifying Information

Once you've gathered the necessary information, the next step is to verify its accuracy. This involves:

- Checking financial statements and credit reports for errors or discrepancies

- Contacting trade references and other relevant parties to confirm information

- Conducting background checks and other due diligence activities

Why is Verifying Information Important?

Verifying information is essential in ensuring that the information provided by the applicant is accurate and reliable. This helps to prevent errors and misrepresentations, which can lead to costly mistakes and financial losses.

Step 3: Assessing Creditworthiness

With verified information in hand, the next step is to assess the creditworthiness of the applicant. This involves evaluating their financial history, credit score, and other relevant information to determine their ability to repay debts.

What Factors Affect Creditworthiness?

Several factors can affect an applicant's creditworthiness, including:

- Credit score and history

- Financial statements and ratios

- Payment history and timeliness

- Industry and market trends

- Management experience and expertise

Step 4: Making a Decision

After assessing the creditworthiness of the applicant, the next step is to make a decision about whether to approve or reject their credit application. This involves weighing the potential benefits and risks of extending credit and making an informed decision based on the available information.

What are the Possible Outcomes?

There are several possible outcomes when making a decision about a credit application, including:

- Approving the application and extending credit

- Rejecting the application and denying credit

- Requesting additional information or clarification

- Offering alternative credit terms or conditions

Step 5: Monitoring and Reviewing

The final step in the principals credit application process is to monitor and review the applicant's creditworthiness on an ongoing basis. This involves:

- Regularly reviewing financial statements and credit reports

- Monitoring payment history and timeliness

- Updating credit scores and other relevant information

- Reassessing creditworthiness as necessary

Why is Monitoring and Reviewing Important?

Monitoring and reviewing an applicant's creditworthiness is essential in ensuring that your business remains protected from potential credit risks. It helps to identify potential issues early on and allows you to take proactive steps to mitigate them.

We hope this article has provided you with a comprehensive understanding of the principals credit application process and its importance in managing credit risks. By following these 5 easy steps, you can protect your business from potential credit risks and ensure a healthy cash flow.

If you have any questions or comments about this article, please don't hesitate to reach out. We'd love to hear from you!

What is a principals credit application?

+A principals credit application is a document used to assess the creditworthiness of a business or individual before extending credit.

Why is gathering information important?

+Gathering accurate and comprehensive information is crucial in assessing the creditworthiness of an applicant.

What factors affect creditworthiness?

+Several factors can affect an applicant's creditworthiness, including credit score and history, financial statements and ratios, payment history and timeliness, industry and market trends, and management experience and expertise.