The frustration and disappointment of having a rental application denied can be overwhelming, especially after investing time and effort into finding the perfect place to call home. If you're wondering why your rental application was denied, you're not alone. In this article, we'll explore the common reasons behind rental application denials and provide valuable insights to help you understand the process and improve your chances of approval in the future.

Understanding the Rental Application Process

Before we dive into the reasons behind rental application denials, it's essential to understand the typical rental application process. When you submit a rental application, the landlord or property manager will usually review your credit report, rental history, income, employment, and other relevant information to determine whether you're a reliable tenant. This evaluation process is designed to minimize the risk of renting to a tenant who may not pay rent on time or take care of the property.

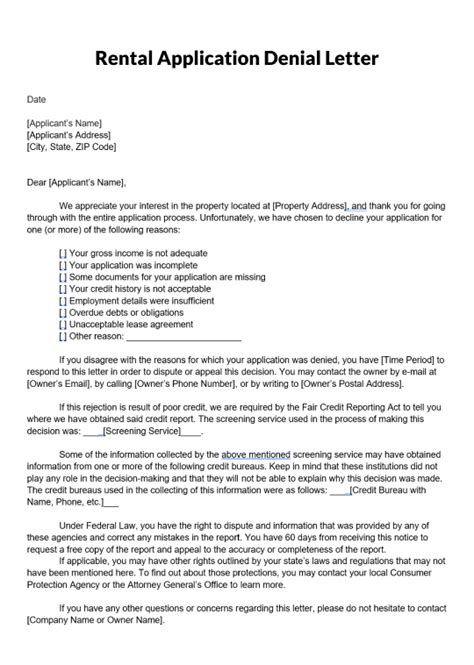

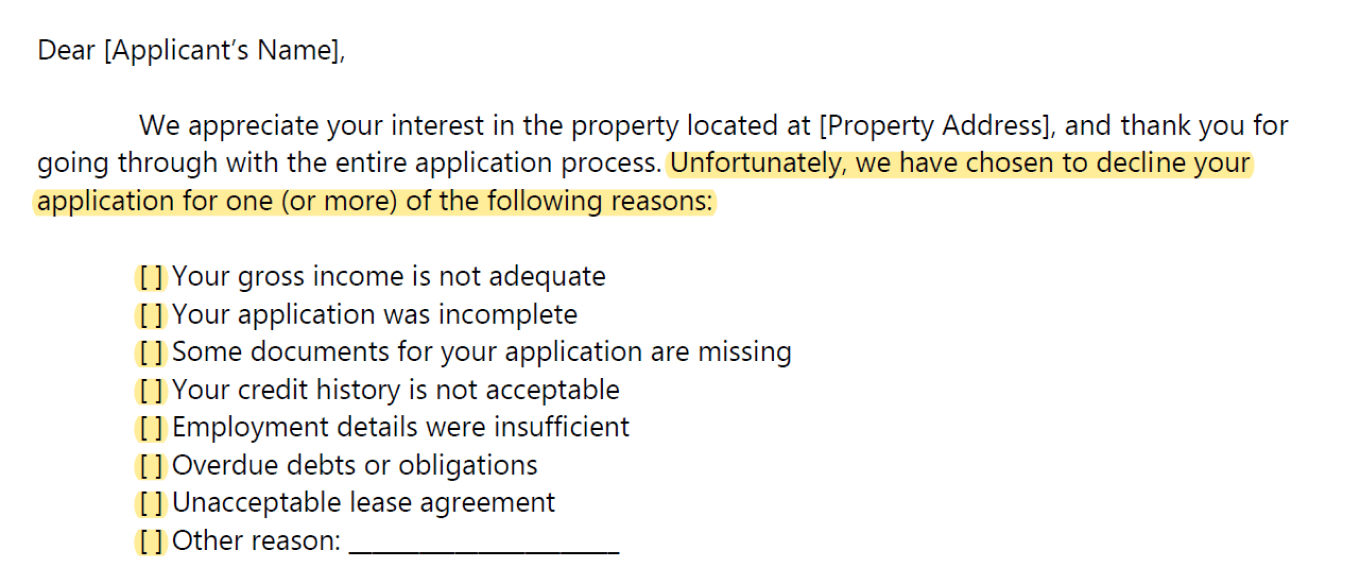

Common Reasons for Rental Application Denial

While each landlord or property manager may have their own set of criteria for approving or denying rental applications, here are some common reasons why your application might be denied:

- Poor Credit History: A poor credit history can be a significant obstacle when applying for a rental property. Landlords want to ensure that you have a history of paying bills on time and managing debt responsibly. If your credit report shows late payments, collections, or bankruptcies, your application may be denied.

- Insufficient Income: Landlords typically require tenants to have a stable income that's sufficient to cover rent payments. If your income is too low or unstable, your application may be denied.

- Rental History: A history of eviction, late rent payments, or property damage can make it challenging to get approved for a rental property.

- Employment History: A stable employment history is crucial when applying for a rental property. If you're self-employed or have a history of job hopping, your application may be denied.

- Too Many Applicants: In competitive rental markets, landlords may receive multiple applications for a single property. If there are other applicants with better credit, more stable income, or a stronger rental history, your application may be denied.

- Pet or Smoking Policies: If you have pets or smoke, you may be denied if the landlord has a no-pets or no-smoking policy.

- Co-Signer Requirements: Some landlords may require a co-signer for applicants with limited credit history or income. If you can't provide a co-signer, your application may be denied.

What to Do If Your Rental Application Is Denied

If your rental application is denied, don't despair. Here are some steps you can take to improve your chances of getting approved in the future:

- Request Feedback: Ask the landlord or property manager for feedback on why your application was denied. This can help you identify areas for improvement.

- Check Your Credit Report: Obtain a copy of your credit report and review it for errors or areas for improvement.

- Improve Your Credit Score: Work on improving your credit score by paying bills on time, reducing debt, and avoiding new credit inquiries.

- Gather Additional Documentation: Make sure you have all necessary documentation, such as proof of income, employment, and rental history.

- Consider a Co-Signer: If you're denied due to limited credit history or income, consider finding a co-signer with better credit or income.

Tips for Improving Your Chances of Approval

While there are no guarantees of approval, here are some tips to improve your chances of getting approved for a rental property:

- Start Early: Begin your rental search early to avoid last-minute applications.

- Be Prepared: Gather all necessary documentation and information before submitting your application.

- Be Honest: Be honest about your credit history, income, and rental history.

- Follow Up: Follow up with the landlord or property manager to ensure your application is being processed.

Conclusion

Having a rental application denied can be disappointing, but it's not the end of the world. By understanding the common reasons behind rental application denials and taking steps to improve your credit, income, and rental history, you can increase your chances of getting approved for a rental property in the future. Remember to stay positive, be prepared, and follow up with the landlord or property manager to ensure your application is being processed.

Gallery of Rental Application Tips

Frequently Asked Questions

What is the most common reason for rental application denial?

+Poor credit history is the most common reason for rental application denial.

How can I improve my chances of getting approved for a rental property?

+Improve your credit score, gather all necessary documentation, and be honest about your credit history and rental history.

What is the typical rental application process?

+The typical rental application process involves reviewing your credit report, rental history, income, employment, and other relevant information.