The job application process can be a daunting and time-consuming experience, with numerous forms to fill out and information to provide. One piece of information that often raises questions is the "tax district" or "taxing district" field. Many job applicants are unsure of what this term means or why it's required on the application. In this article, we'll delve into the world of tax districts, explaining their purpose, how they work, and what you need to know when filling out a job application.

What is a Tax District?

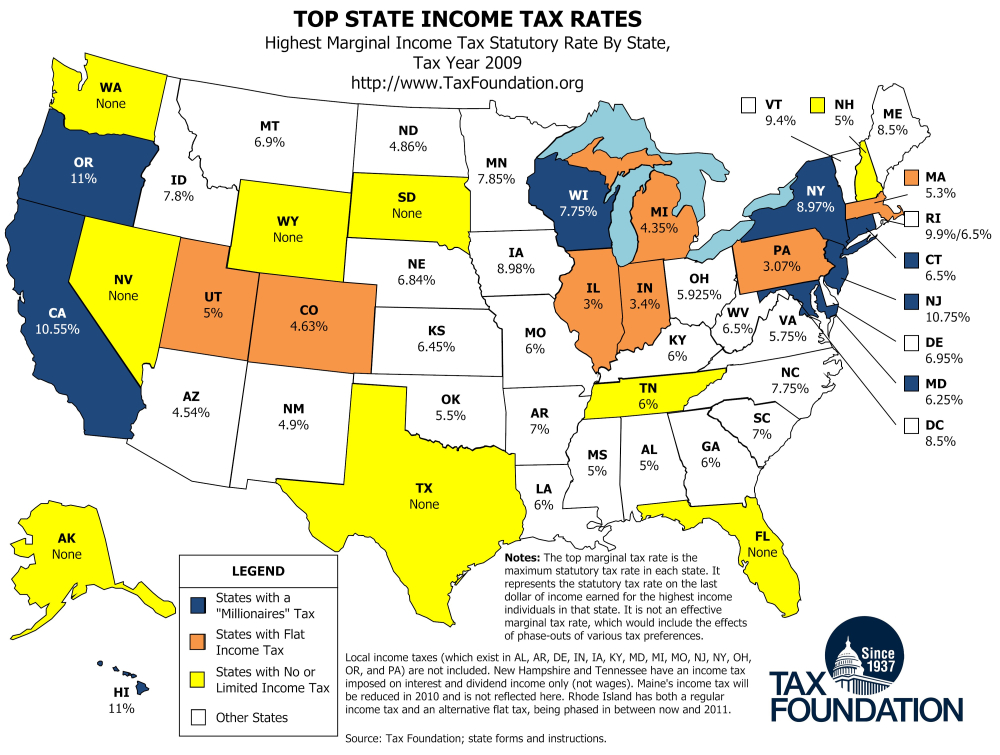

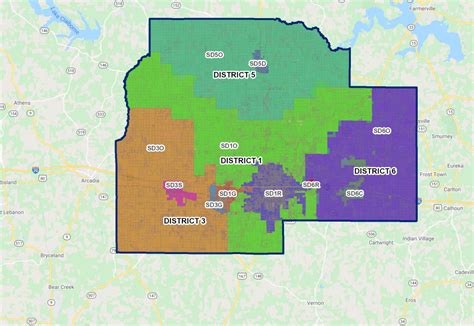

A tax district, also known as a taxing district, is a geographic area that is used to determine the tax rates and revenue allocation for local governments, schools, and other public entities. Tax districts are typically established by state or local governments to manage the collection and distribution of taxes, which fund various public services and infrastructure. These services may include schools, law enforcement, road maintenance, and public transportation, among others.

Tax districts can be based on various geographic boundaries, such as cities, counties, school districts, or special districts (e.g., water or sewer districts). The tax rates and revenue allocation within each district can vary significantly, depending on the local government's policies and the needs of the community.

Why is Tax District Information Required on Job Applications?

When applying for a job, you may be asked to provide your tax district information, which is usually in the form of a code or number. This information is required for several reasons:

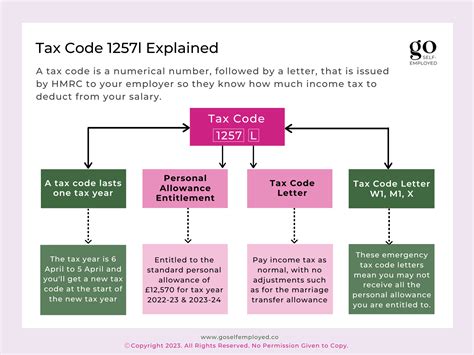

- Tax Withholding: Employers need to know your tax district information to determine the correct tax withholding rates for your paycheck. This ensures that the correct amount of taxes is withheld and remitted to the relevant tax authorities.

- Benefits and Compensation: Some employee benefits, such as health insurance or retirement plans, may be tied to specific tax districts. By providing your tax district information, your employer can determine your eligibility for these benefits and ensure that you receive the correct compensation.

- Compliance with Tax Laws: Employers must comply with various tax laws and regulations, including those related to tax districts. By collecting and reporting tax district information, employers can ensure that they are meeting their tax obligations and avoiding potential penalties.

How to Find Your Tax District Information

If you're unsure about your tax district information, there are several ways to find it:

- Check Your Tax Returns: Your tax returns, such as your W-2 or 1099 forms, may include your tax district information.

- Contact Your Local Government: Reach out to your local government or tax authority to ask about your tax district information. They may be able to provide you with the necessary codes or numbers.

- Check Online Resources: Many states and local governments provide online resources, such as tax district maps or lookup tools, to help you find your tax district information.

Tips for Filling Out Tax District Information on Job Applications

When filling out a job application, make sure to provide accurate and complete tax district information. Here are some tips to keep in mind:

- Double-Check Your Information: Verify your tax district information before submitting your application to ensure accuracy.

- Use the Correct Format: Follow the format specified on the application, whether it's a code, number, or written description.

- Ask for Help if Needed: If you're unsure about your tax district information, don't hesitate to ask the employer or a tax professional for assistance.

Understanding Tax District Codes

Tax district codes are used to identify specific tax districts and determine the correct tax rates and revenue allocation. These codes can be in the form of numbers, letters, or a combination of both. Here are some common types of tax district codes:

- Geographic codes: These codes are based on geographic boundaries, such as city or county codes.

- Tax rate codes: These codes determine the tax rates applied to specific tax districts.

- Revenue allocation codes: These codes determine how tax revenue is allocated within a tax district.

Common Tax District Codes

Here are some common tax district codes you may encounter:

- FIPS codes: Federal Information Processing Standard (FIPS) codes are used to identify geographic areas, such as counties or cities.

- NAICS codes: North American Industry Classification System (NAICS) codes are used to classify businesses and determine tax rates.

- SIC codes: Standard Industrial Classification (SIC) codes are used to classify businesses and determine tax rates.

Gallery of Tax District Maps and Codes

FAQs About Tax Districts and Job Applications

What is a tax district, and why is it required on job applications?

+A tax district is a geographic area used to determine tax rates and revenue allocation. It's required on job applications to ensure accurate tax withholding and compliance with tax laws.

How do I find my tax district information?

+You can find your tax district information on your tax returns, by contacting your local government, or using online resources such as tax district maps or lookup tools.

What happens if I provide incorrect tax district information on a job application?

+If you provide incorrect tax district information, it may lead to errors in tax withholding or benefits allocation. It's essential to double-check your information before submitting your application.

In conclusion, understanding tax districts and their role in job applications is essential for ensuring accurate tax withholding and compliance with tax laws. By providing correct tax district information, you can avoid potential errors and ensure that you receive the correct benefits and compensation. Remember to double-check your information and seek help if needed to ensure a smooth and successful job application process.