Are you a homeowner in Broward County, Florida, looking to reduce your property taxes? If so, you may be eligible for the Homestead Exemption. This exemption can save you hundreds, if not thousands, of dollars on your annual property tax bill. In this article, we'll guide you through the process of applying for the Homestead Exemption in Broward County, including the benefits, eligibility requirements, and step-by-step instructions.

What is the Homestead Exemption?

The Homestead Exemption is a tax exemption provided by the State of Florida to eligible homeowners. It exempts a portion of the home's value from property taxes, resulting in lower tax bills. The exemption can be up to $50,000, with the first $25,000 exempt from all property taxes and the remaining $25,000 exempt from non-school taxes.

Benefits of the Homestead Exemption

The Homestead Exemption provides several benefits to eligible homeowners:

- Reduced property taxes: By exempting a portion of the home's value from property taxes, homeowners can save hundreds or even thousands of dollars on their annual tax bill.

- Increased savings: The exemption can help homeowners save money on their property taxes, which can be used for other expenses or invested in their home.

- Protection from rising property taxes: With the Homestead Exemption, homeowners are protected from rising property taxes, as the exemption amount is adjusted annually to reflect changes in the consumer price index.

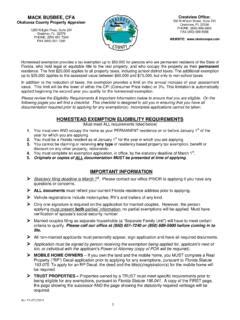

Eligibility Requirements

To be eligible for the Homestead Exemption, homeowners must meet the following requirements:

- The home must be the owner's primary residence.

- The owner must have a valid social security number or individual taxpayer identification number.

- The owner must be a Florida resident.

- The owner must have a recorded deed or a contract to purchase the property.

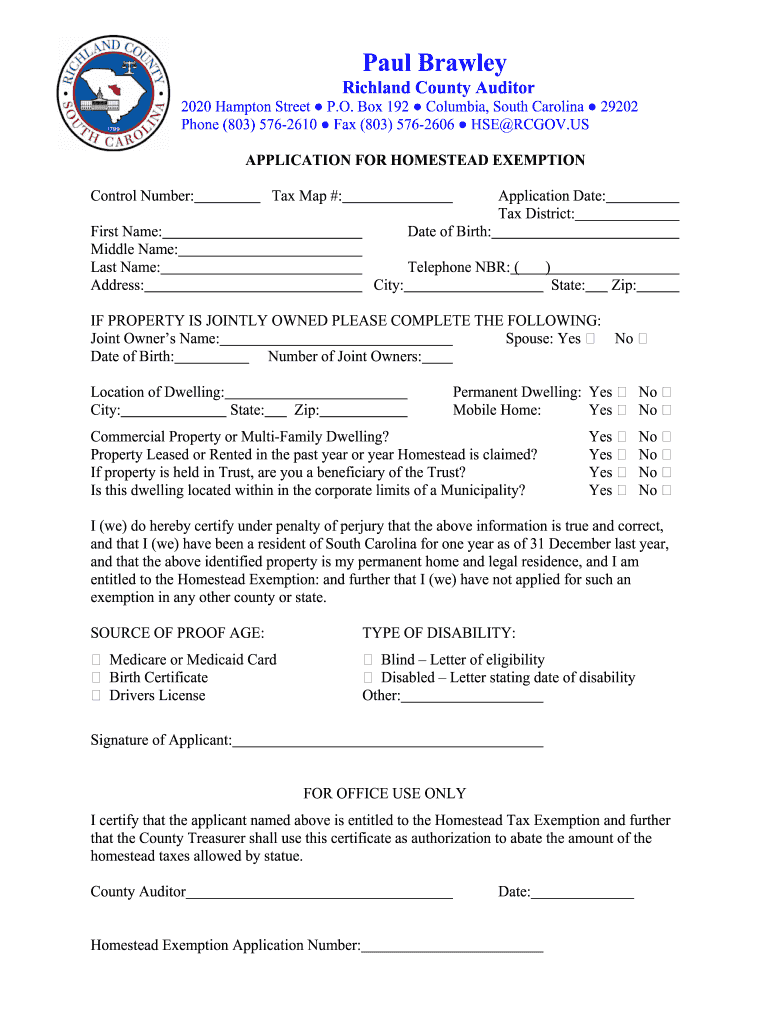

Step-by-Step Application Guide

To apply for the Homestead Exemption in Broward County, follow these steps:

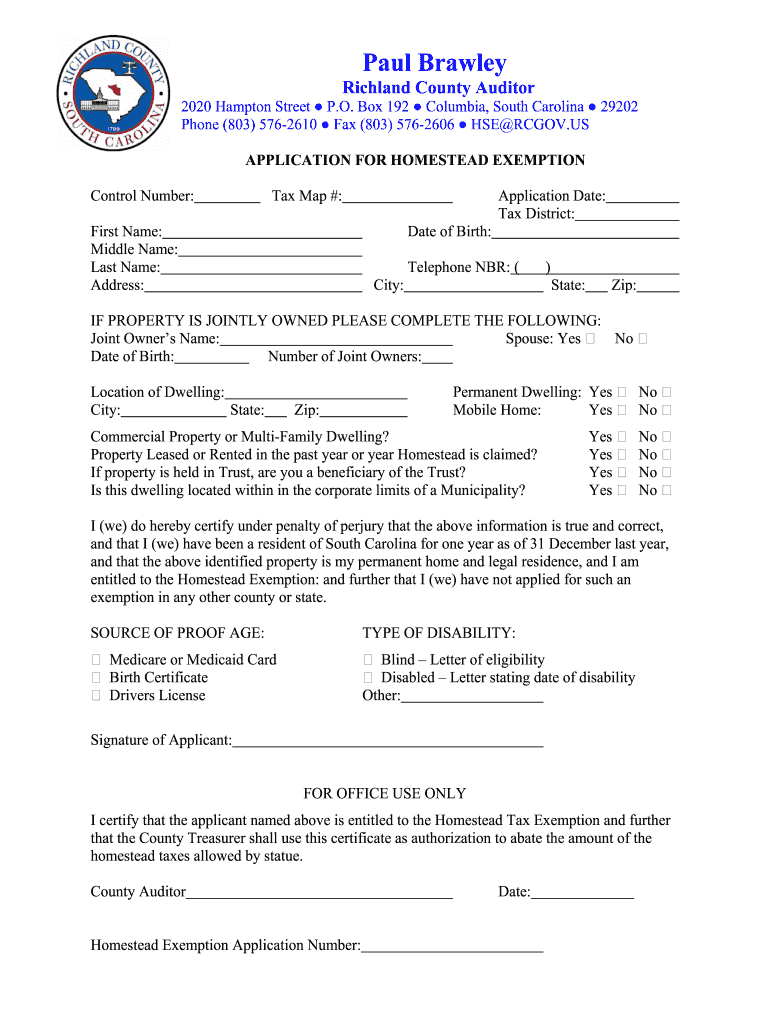

- Gather required documents: You'll need to provide proof of ownership, such as a recorded deed or a contract to purchase the property. You'll also need to provide a valid social security number or individual taxpayer identification number.

- Determine your eligibility: Review the eligibility requirements to ensure you qualify for the Homestead Exemption.

- Fill out the application: You can download the application form from the Broward County Property Appraiser's website or pick one up at their office.

- Submit the application: Submit the completed application form and required documents to the Broward County Property Appraiser's office.

- Wait for approval: The Property Appraiser's office will review your application and notify you of the approval or denial of your exemption.

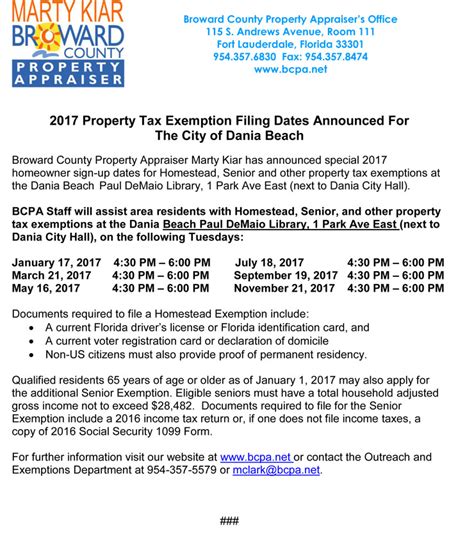

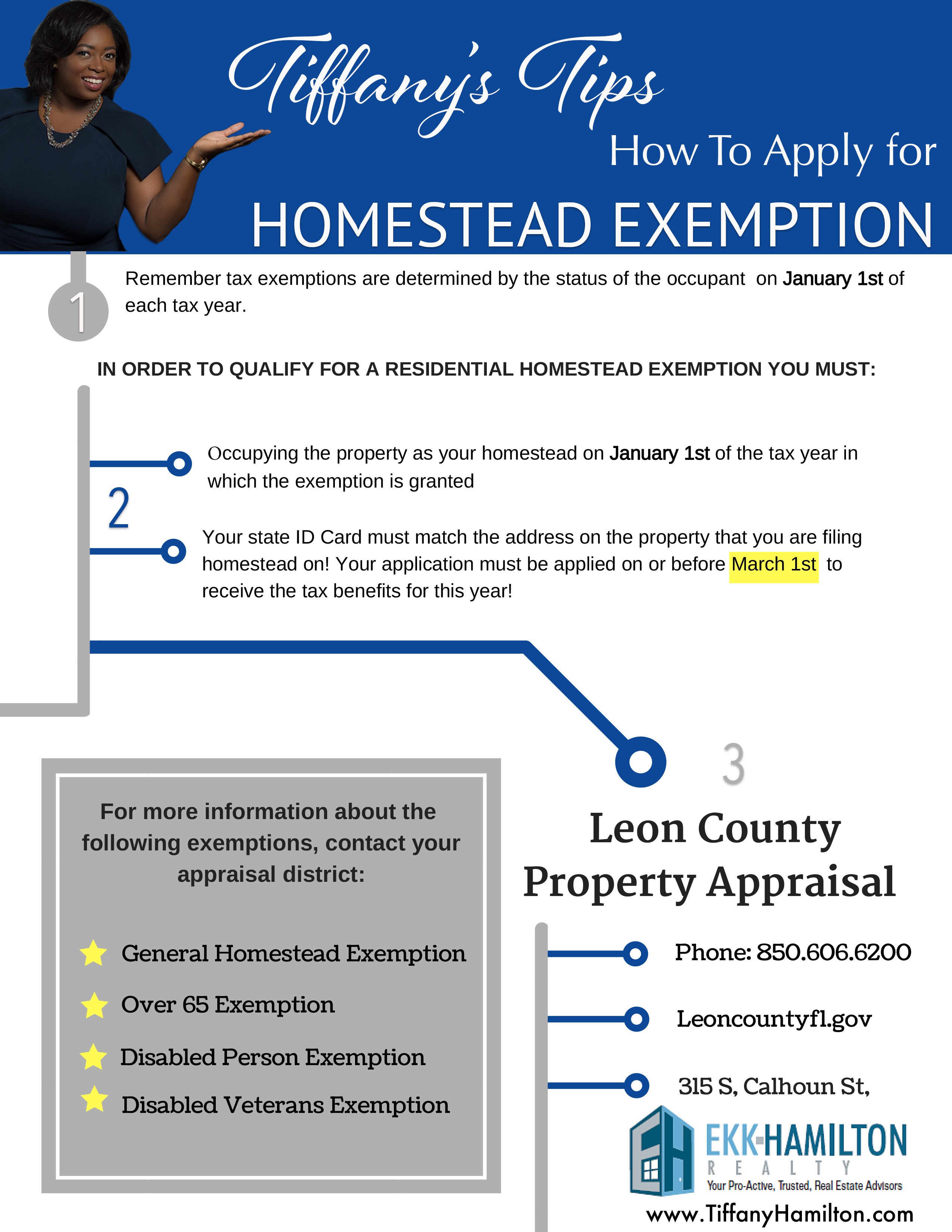

Timeline and Deadlines

The deadline to apply for the Homestead Exemption in Broward County is March 1st of each year. If you miss the deadline, you can still apply for a late exemption, but you'll need to provide a valid reason for the late application.

Additional Exemptions

In addition to the Homestead Exemption, there are other exemptions available to homeowners in Broward County, including:

- Senior Exemption: Eligible seniors may be entitled to an additional exemption of up to $25,000.

- Disability Exemption: Homeowners with a disability may be eligible for an additional exemption of up to $25,000.

- Veterans Exemption: Eligible veterans may be entitled to an additional exemption of up to $25,000.

Conclusion

The Homestead Exemption is a valuable tax exemption that can save homeowners in Broward County hundreds or even thousands of dollars on their annual property tax bill. By following the step-by-step application guide and meeting the eligibility requirements, homeowners can take advantage of this exemption and enjoy the benefits of lower property taxes.

Gallery of Broward County Homestead Exemption

FAQ

What is the deadline to apply for the Homestead Exemption in Broward County?

+The deadline to apply for the Homestead Exemption in Broward County is March 1st of each year.

How much can I save with the Homestead Exemption?

+The amount you can save with the Homestead Exemption varies depending on the value of your home and the local property tax rate. However, the exemption can save you hundreds or even thousands of dollars on your annual property tax bill.

Do I need to reapply for the Homestead Exemption every year?

+No, once you've been approved for the Homestead Exemption, you don't need to reapply every year. However, you may need to provide additional documentation or information to maintain your exemption.